Electric vehicle startups like Tesla, Polestar, and Rivian have changed the direct-to-consumer (DTC) car sales model from a novelty to the norm for some consumers. The D2C movement is also showing the cracks in the traditional dealership model, and OEMs are taking notice.

Even industry stalwarts like Ford are moving to a “build-to-order” model where customers can reserve and build their vehicle online and pick it up in a couple of weeks or months. Popular new models like the Maverick, F-150 Lightning, and Mach-E can be built and pre-ordered online. In some cases, that’s the only way consumers can get their hands on one. Ford has also said that it wants to restructure its dealership model, including building an e-commerce platform where customers can shop for and buy EVs at non-negotiable prices to counter consumer pushback to dealer markups.

What does the D2C car sales movement mean for dealerships and OEMs? Are consumers even ready to click their way through a $40,000+ purchase? The time for D2C car buying might be closer than you think, so now is the time to consider the digital future of the car dealership.

What is Direct-to-Consumer Car Sales?

The direct-to-consumer, or D2C, car sales model enables consumers to purchase vehicles directly from the manufacturer without the involvement of a traditional dealership. In the D2C experience, car buyers shop, configure, and order their vehicles online, as well as complete the financial side of the purchase process like credit checks, lease agreements, and financing.

Direct-to-consumer sales models thus far are one-price affairs: the price you see when you configure your vehicle is the price that you pay. There’s no haggling over prices or financing, which all but the most dedicated wheeler-dealers should enjoy.

Test drives are still available before ink is put on paper, too. D2C natives like Tesla, Polestar, and Rivian have showrooms where you can drive and get more information about their cars from highly-trained representatives. Note that they don’t call them “dealerships” and they don’t have “salespeople” at all—Polestar, for example, call them “spaces” and the people helping you are “specialists”.

The spaces are designed to allow consumers to explore at their own pace without pressure, learn about the vehicles, and get expert assistance if they want it. Having experienced this myself, I can say that the specialists are indeed highly knowledgeable and there is zero pressure applied. The specialist doesn’t even go on the test drive with you. It’s just the right amount of the human touch—and of course the prerequisite test drive—to make potential buyers confident that they are making the right decision.

The Difference Between D2C and Digital Dealerships

Most OEMs and dealer networks employ what’s known as the digital dealership, but it’s not the same as a D2C model. The digital dealership is essentially the dealer or OEMs online storefront where consumers can learn about vehicles, shop for cars and (ideally) get prices and view local inventory.

Most of the time, car buyers can't complete the purchase process fully online in a digital dealership experience. More often, though, they can take care of things like credit checks, review financing offers, and schedule test drives at their local dealerships. Digital dealerships allow consumers to do most of their shopping online before coming to the showroom.

According to a survey conducted by CDK Global, 90% of automotive consumers want to start the car buying process online, so the quality of your digital dealership presence is a critical piece of acquiring more customers.

Why OEMs Are Considering to D2C-Like Buying Experiences

There are many reasons why OEMs and even some dealers are considering and implementing D2C-like car buying experiences. The first big push is coming from the supply chain shortages that have been impacting the industry for the last two years. They just don’t have the cars available to give dealers allocations, but demand for cars is at an all-time high. Enabling consumers to reserve cars online has been incredibly successful, in some cases, maybe too successful. Virtual allocations of popular models have frequently closed only months after a new vehicle has launched. For example, Ford said it received an astonishing 86,000 orders for the Maverick in one week in September 2023, closing the order books before the year even begins. This is sure to create some FOMO, but also a bit of frustration.

The build-and-reserve online model also creates an air of exclusivity around new models, particularly limited editions and new EVs. Since you can only order it online and consumers are aware that supplies are limited, they’re more likely to drop a deposit to get the hottest new EV in their driveway before the neighbors do.

The primary reason that dealers should be interested in a D2C-hybrid model is that alloacations are expensive. The cost of goods on hand for dealers is huge, and pushing consumers to order online significantly reduces the inventory that they need to keep on the lot.

Many Consumers Aren’t Ready for D2C Online Car Buying

The big roadblock for D2C car sales may be that many consumers aren’t yet ready for a mostly-online car buying experience. Deloitte’s Global Automotive Consumer Study found that 71% of American consumers still want to buy in person. A survey conducted by Harris Poll on behalf of Sonic Automotive found that 64% still aren’t comfortable buying entirely online.

Both of these studies did find a strong preference for conducting much of their research, shopping, and some of the buying process online, though. The parts that car buyers would prefer to do online instead of in-person include:

- Search for a car (80%)

- Determine the final price (78%)

- Schedule an appointment to take possession of the car (76%)

- Value their trade-in vehicle (75%)

- Conducting credit checks and financing (74%)

- Review and purchase insurance or extended warranty products (73%)

This signals that the dealership isn’t going anywhere any time soon, but dealers and OEMs still need to meet customers where they are and improve the entire omnichannel experience to meet their changing expectations.

The Digital Dealership Needs to Bridge the Gap Between D2C and Traditional Dealers

While many car buyers aren’t ready for an online D2C buying experience, they still expect a seamless online experience when shopping for a car. And they may never step foot in your showroom if your digital dealership is not up to par with modern eCommerce experiences.

Today’s consumers will not tolerate a poor digital experience, and there’s no reason that they should when making a five-figure purchase. According to Invoca’s 2022 Buyer Experience Report, 76% of consumers will stop doing business with you after just one bad experience, so there is little room for error. This also means you have to make a serious investment in your digital dealership to put your best foot forward and get more ups on the phone and walking into the showroom.

Put yourself in the shoes of your customer—when you’re shopping for anything, you want to see some basic stuff—is what you want available, what options are available, and how much does it cost. Many “digital dealerhips” fail to provide even this basic information, often purposely obfsucating it in order to entice people to call or come in before they reveal a price or inventory. Would you tolerate this kind of online experience if you were shopping for a refrigerator? Probably not, and consumers like it even less when they’re shopping for a $50,000 SUV.

The modern digital dealership must provide a frictionless shopping experience for every customer, no matter how much or how little of the purchase process they want to complete online. Your full inventory should be updated in real time, prices should be clearly displayed, and customers should be able to do everything from scheduling a test drive to getting approval for financing in a true digital dealer experience.

Many car buyers are rightfully getting frustrated with bad online experiences because they are used to a much more refined online shopping experience. Your website has to be modern, easy to navigate, and provide all of the information that consumers need.

Hybrid Buying Experiences Bring Marketing and Customer Experience Challenges

Though most car buyers start their buying journey online, ultimately they will call your dealership before they come in for that test drive. In the Buyer Experience Report, we found that 67% of shoppers call before buying car. Additionally 47% said that they expect the most personalized experience when they call—more than online or any other channel.

This means that you have to connect the online and offline customer journey to provide a seamless, friction-free experience for every customer. Creating an efficient and effective experience requires full visibility into your customers’ buying journey. You need to know how they discovered you, how they interacted with you, and ultimately, how and through what channel they became a customer. If you’re missing what’s happening in your conversations with your customers, you don’t have a full-funnel attribution and you can’t fully understand your customers and optimize your media spend.

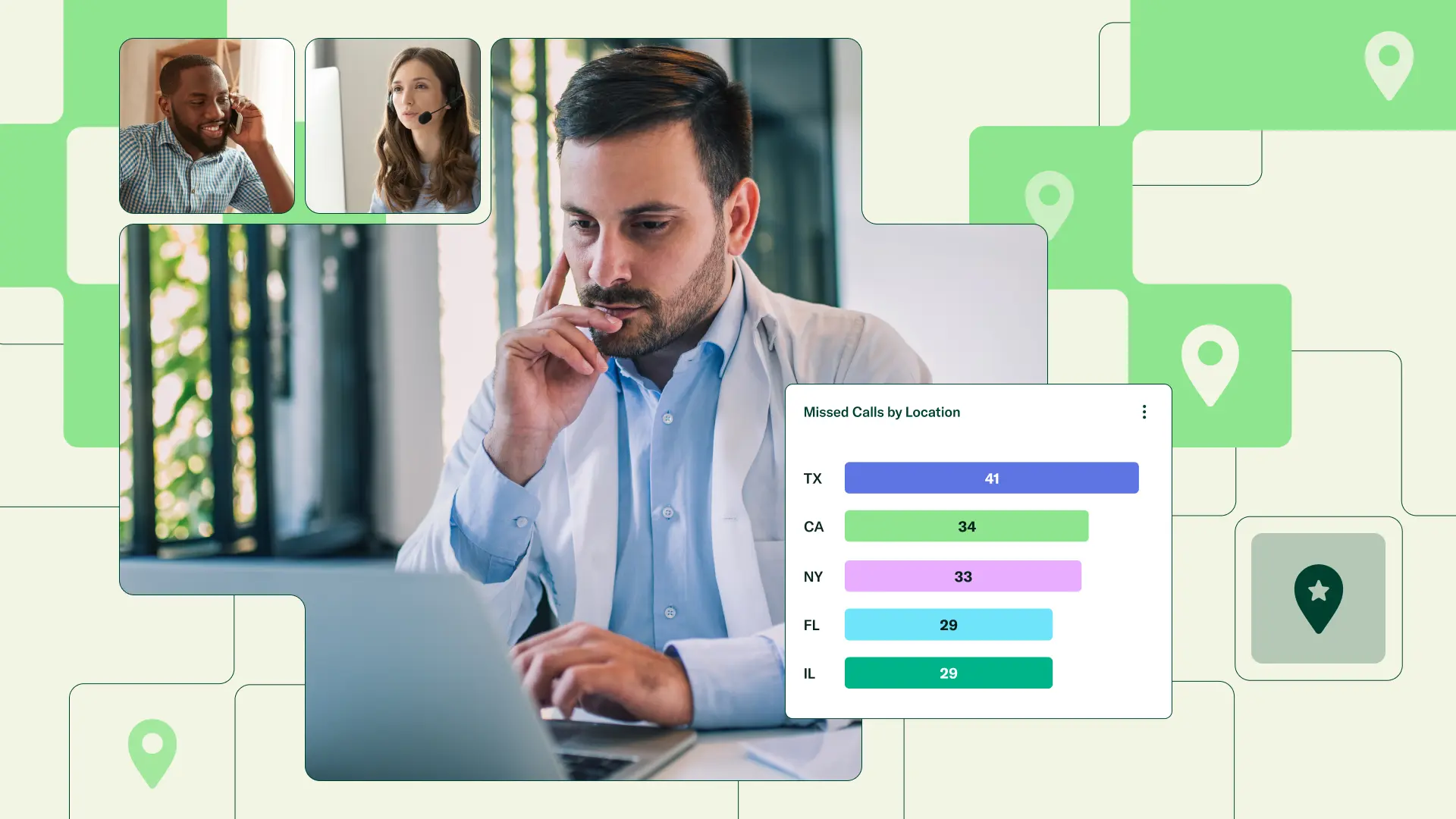

By using an automotive conversation intelligence solution like Invoca, you can get full visibility of the buying journey from click, to call, to appointment. You can capture data like search keywords, click IDs, campaigns, and more to tie revenue generated by campaign-driven phone leads. You can finally see what’s actually driving leads, what’s driving low-value calls, and how you can improve the entire buying journey.

You can also provide your dealership sales staff with data about the customer’s digital journey that preceded the call so they can provide a more personalized customer experience. Once the call is routed to the best location to assist the customer, Invoca can help your salespeople take the experience to the next level with pre-call whisper messages or screen pops. Your agents will receive these messages before they answer the phone, providing them with valuable insights on callers, such as their name, geographic location, any marketing campaigns they interacted with, and the webpage they called from.

Your agents can use this information to anticipate the caller’s needs, pull up any relevant information, and tailor the conversation accordingly. For example, if the consumer placed a phone call from your “Toyota Highlander” webpage, you could proactively pull up inventory information for the vehicle and be ready to answer questions about financing options. This creates a seamless digital-to-call experience that makes each caller more likely to convert.

Pre-call data also reduces call times, since agents already know the context of each call and can jump right into the conversation. This improves efficiency and allows your agents to handle more calls, reducing unanswered call rates.

Schedule a personalized demo today to see how you can improve your digital dealership experience and convert more ups into customers.

Additional Resources: